Posts

Showing posts from 2011

Why the ECB independence is detrimental in times of crisis

- Get link

- X

- Other Apps

Time for the Fed to take over in Europe - Opinion - Al Jazeera English

- Get link

- X

- Other Apps

Are people unemployed because safety nets are too generous?

- Get link

- X

- Other Apps

Who will foot the bill? Distribution of EFSF commitments

- Get link

- X

- Other Apps

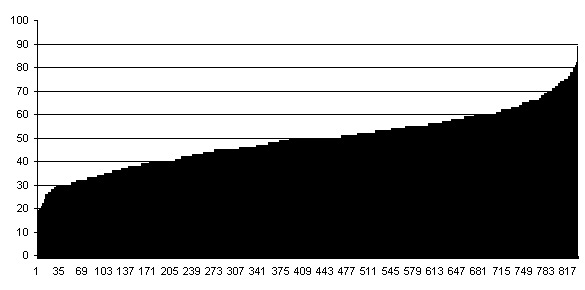

High unemployment: Cyclical or Structural? Guess from the Graph...

- Get link

- X

- Other Apps

Higher income earners are more likely to vote Republican

- Get link

- X

- Other Apps

Socialist austerity: here comes the conservatives

- Get link

- X

- Other Apps

Household Debt Contributes to Unemployment

- Get link

- X

- Other Apps

De Grauwe "Who cares about the survival of the eurozone?"

- Get link

- X

- Other Apps

Active labour market policies in the crisis

- Get link

- X

- Other Apps

UK unemployment in the crisis: ILO measure versus claimant count

- Get link

- X

- Other Apps

Inequality and the politics of the welfare state in the US

- Get link

- X

- Other Apps

La grande braderie - 1980s French Privatisation

- Get link

- X

- Other Apps

Debunking the myth that the working class is responsible for the crisis

- Get link

- X

- Other Apps

"Back to the future": Privatisation as a solution to problems

- Get link

- X

- Other Apps

The Economist's interactive guide to reducing government debt

- Get link

- X

- Other Apps

Bringing Capitalism back into the debt debate

- Get link

- X

- Other Apps

Europe needs a large Social Sciences and Humanities -centered research programme to tackle its "Grand Societal Challenges"!

- Get link

- X

- Other Apps

Wages and unemployment in the current crisis

- Get link

- X

- Other Apps

New report by the European Foundation for the improvement of Living and Working conditions

- Get link

- X

- Other Apps

The Organisation for Economic Cooperation and Development at 50

- Get link

- X

- Other Apps

The state of the union address of the president of the European Commission

- Get link

- X

- Other Apps

On the problem of trading short term pains for long term gains

- Get link

- X

- Other Apps

When Marx Met Engels, the Renegade Industrialist - in Bloomberg

- Get link

- X

- Other Apps

Experimentation as a solution to poverty

- Get link

- X

- Other Apps

IMF confirms what we already knew: Austerity is bad for the economy!

- Get link

- X

- Other Apps

The Robin hood syndrome among the rich is spreading

- Get link

- X

- Other Apps

The role of actors in welfare state development

- Get link

- X

- Other Apps

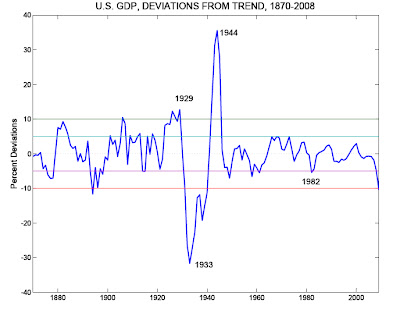

Delong on pros and cons of US expansionary policy

- Get link

- X

- Other Apps

The Socio economic determinants of labour market policies

- Get link

- X

- Other Apps

To What Extent Did the Financial Crisis Intensify the Pressure to Reform the Welfare State?

- Get link

- X

- Other Apps

Welfare regimes and Youth Unemployment rates in the crisis

- Get link

- X

- Other Apps

10 years of labour government in the UK

- Get link

- X

- Other Apps

1 million people against unpaid internships

- Get link

- X

- Other Apps

Misconceptions about working time in the EU27

- Get link

- X

- Other Apps

Statisticless homeless deaths in France

- Get link

- X

- Other Apps

The crisis: Deficits as the temporary fix in the tensions between legitimation and accumulation

- Get link

- X

- Other Apps

Statement of the Council of the European Union on Greece and related matters

- Get link

- X

- Other Apps

The dependent variable problem in quantitative studies of Active Labour Market Programmes: Uncovering hidden dynamics?

- Get link

- X

- Other Apps

When It Comes to Argentinas Economy, the NYT Redefines "Stagnant"

- Get link

- X

- Other Apps

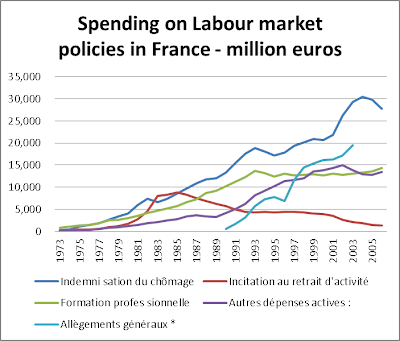

The evolution of French Labour Market Policy

- Get link

- X

- Other Apps

How the internet is revolutionising research

- Get link

- X

- Other Apps

Krugman and Eggertsson on why more spending may make sense even when debt is high

- Get link

- X

- Other Apps

Humala likely winner of Peruvian Presidential elections!

- Get link

- X

- Other Apps

Academic journal dedicated to studying my home town

- Get link

- X

- Other Apps

A Competent candidate withdraws his nomination...

- Get link

- X

- Other Apps

Beyond Strauss-Kahn: Facts on the prevalence of rapes in France

- Get link

- X

- Other Apps

Robert Lucas on the crisis: causes and consequences

- Get link

- X

- Other Apps

New LSE European Institute working papers

- Get link

- X

- Other Apps

SASE 23rd Annual Conference - Madrid June 23-25

- Get link

- X

- Other Apps

Institutional stability in European welfare states

- Get link

- X

- Other Apps

Back from the dead? Understanding the death of Keynesianism and its potential revival

- Get link

- X

- Other Apps

Financial storm versus nature's tsunami: impact on the NIKKEI225 index

- Get link

- X

- Other Apps